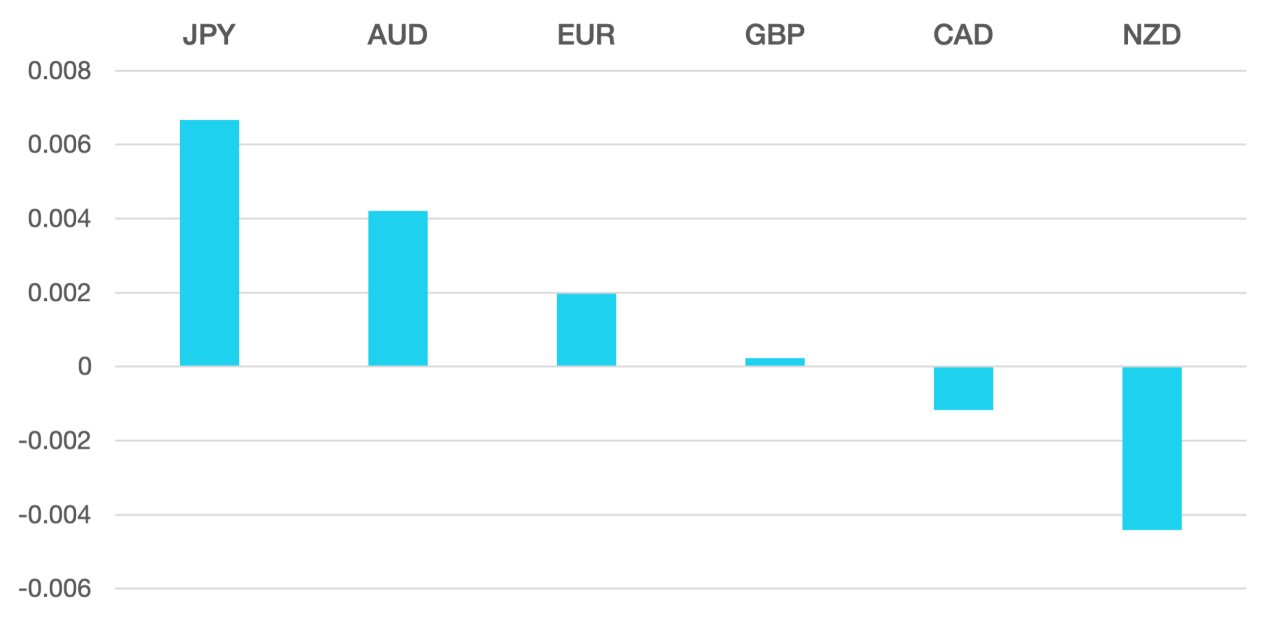

Last week we saw the Yen continue to fall breaking the 160-level vs the US Dollar and tumbling against the other majors to hit multi decade lows.

In spite of this the BoJ continues to stay on the sidelines refusing from intervening directly, but further falls were tempered as traders felt that any intervention would lead to sharp reversal.

The AUD followed on from last week gaining the most. Traders are looking to the RBA to signal if a further rate increase is in the not-too-distant future following strong inflationary data.

EUR rallied showing an unexpected upturn despite the increased political uncertainty. Risk debt premiums did surge with the French German bond spreads the highest since 2012.

Oil gained for the third week, but its upward trend does seem to be losing momentum. The WTI rallied 1.1% to close just below $81.50.

The week ahead is a shorter week but with much packed in. Thursday is the US holiday which will leave markets quiet for the second half but with the UK general election along with payroll numbers on Friday it could be an exciting end.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Yen Continues to Fall first appeared on trademakers.

The post Yen Continues to Fall first appeared on JP Fund Services.

The post Yen Continues to Fall appeared first on JP Fund Services.